Hey folks, Tim here.

There’s a huge opportunity right now on NVIDIA Corporation (NASDAQ: NVDA)!

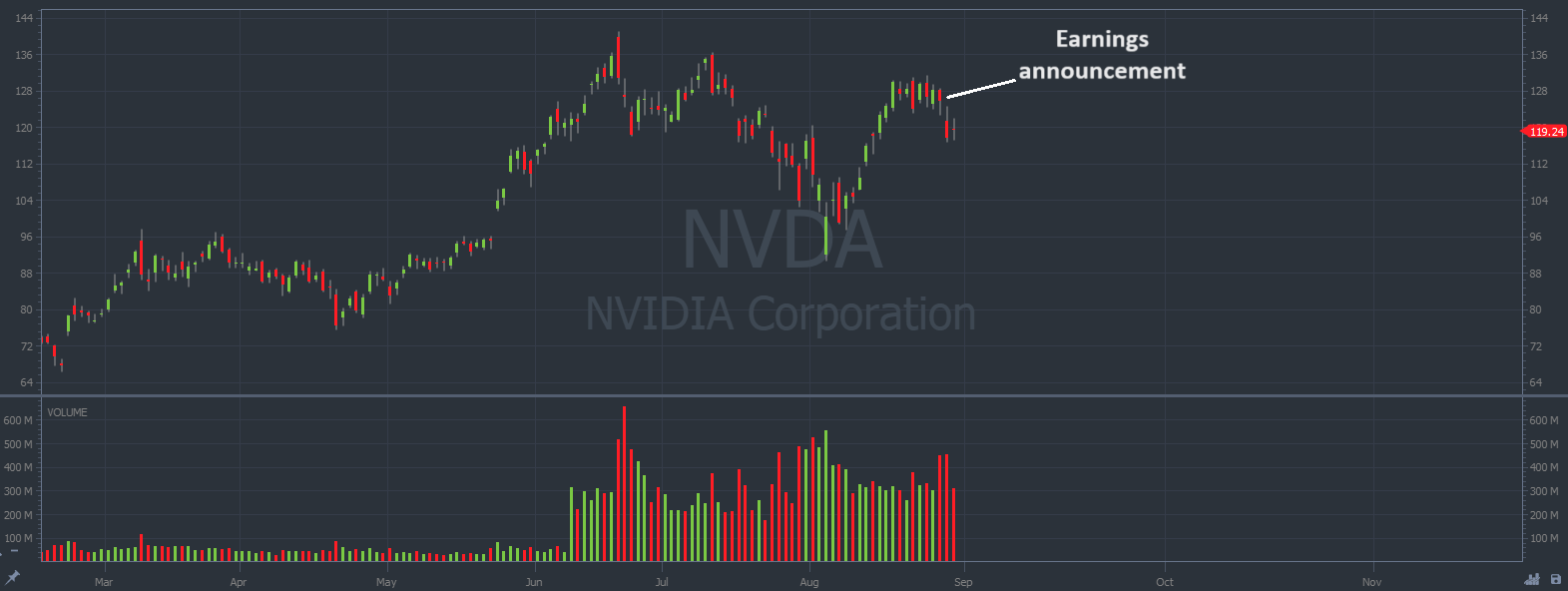

I saw a bunch of people pile into the stock before the earnings announcement on Wednesday afternoon. And despite the bullish revenue data, the stock sank on Thursday.

That’s why we don’t hold shares of a company through a big event like that: Nobody knows what the price will do for certain.

It’s a classic trading rule called, “buy the rumor, sell the news”.

We can trade the price action before and after a big announcement, but we don’t want to hold shares through it.

Now that we’re on the other side of the earnings catalyst, we can effectively build a SMART swing-trade position.

Here’s the reality behind the NVDA earnings from last week, as I see it:

- Revenue: $30.04 billion vs. $28.7 billion expected. A beat by more than $1 billion!

- This is a wildly profitable company in the middle of an expanding tech/AI market. And it’s currently trading at a discount.

Take a look at the chart below for reference, every candle represents one trading day:

NVDA chart multi-month, 1-day candles Source: StocksToTrade

But nothing is a 100% guarantee in the market … as we’ve already seen, the price action doesn’t always behave ‘logically’.

That’s why it’s important to follow a framework for swing-trade setups.

Our AI swing-trading bot, Iris, follows my specific process for trading these larger-cap stocks.

👉 Use Iris to build smart positions on NVDA! 🧠

This volatility kicks off again on Tuesday … I’ve got a 5-stock watchlist to ensure you’re prepared for the runners that are still in play.

But Tuesday’s #1 runner could come from a stock that announces news during premarket …

On Tuesday we’ll meet LIVE during premarket to scope out the next most volatile penny stock setups.

Here’s the link for our Pre-Market Prep sessions every day this week. It’s where we track the hottest stocks for upcoming trade opportunities every morning.

But for all of your swing-trading needs … This is the watchlist for the whole week!

Here’s what I’m watching this week (see my video and details below)…

- PayPal Holdings Inc. (NASDAQ: PYPL)

- Novavax Inc. (NASDAQ: NVAX)

- Altria Group Inc. (NYSE: MO)

- 3M Company (NYSE: MMM)

- Box Inc. (NYSE: BOX)

Weekly Top Stocks List: September 01, 2024

Remember: This watchlist is in no way a recommendation to buy. Traders should always do their own research and make their own decisions.

Here’s what I’m watching based on my StocksToTrade scans. Study and learn from them all!

This is the link for our AI Iris swing-trade bot that I mention in the watchlist.

I use IRIS for all my swing trade ideas. It was programmed to look for stocks using the same process I use. Now it does the work for me. Get IRIS, punch in your ticker, and get a full report and trade plan in a few minutes!

Speed up your swing trade-picking process with our IRIS AI analyzer here.

Take Your Trading To The Next Level

The best way to stay on top of daily opportunities in the market is by keeping your finger on the pulse of the market…

It can be tough when you have a job and other commitments.

But my team and I are here to help!

We go LIVE daily to show you the hottest stocks that are moving and show you a system to help you take your trading to the next level.

Join our next FREE live webinar NOW!

PayPal Holdings Inc. (NASDAQ: PYPL)

Earnings winner from last week.

I love this play if it can hold support around $72.50.

Novavax Inc. (NASDAQ: NVAX)

This is the speculative play that I’m watching on Tuesday morning.

There was some Breaking News about COVID that could spread over the long weekend.

I’m watching for a potential dip and rip when the market opens.

Altria Group Inc. (NYSE: MO)

Iris still likes this stock all these weeks later. And the price keeps grinding higher.

Use Iris to build a smart position on this runner.

3M Company (NYSE: MMM)

This is another Iris pick from a few weeks ago. The price just broke to new 52-week highs.

You don’t have to watch these slower-moving stocks for short term price changes. We’re swing trading these runners.

Box Inc. (NYSE: BOX)

Another earnings winner.

Look for breaks of $33 while using Oracle’s $32.60 level as potential risk.

StocksToTrade

How do I go about finding these watchlist picks?

I use StocksToTrade scans, of course. With awesome charting software and built-in scans, STT has everything traders need to help narrow down the thousands of stocks out there into a manageable watchlist.

See for yourself! Try StocksToTrade today!

Or get a 14-day trial of StocksToTrade with the Breaking News Chat add-on for just $17.

Learn Something from Every Pick

A watchlist isn’t a ‘must trade’ list. It’s a learning tool that can help improve traders’ knowledge of the stock market.

Every trading decision should be your own. Always do your own research, run your own scans, and keep an eye on the market.

This watchlist is NOT a recommendation to buy. This is for educational purposes only — watch, learn, and use it to help you improve every day!

The Little-Known Trading Trick For Part-Time Traders

I want to show you the biggest overlooked opportunity in the market right now… It’s not on the radar of mainstream media or T.V. talking heads …Yet, it has helped many of my top students walk away with thousands in profits from a single trade.

And the best part is, you don’t have to monitor these trades for hours on end, making them great for part-time traders. I’ve used it myself for years and today I’m sharing it with you in this short video.

*Past performance does not indicate future results