The theme of this weekly watchlist — and 2020 in general? Too many stocks!

If you’ve been following me on my Pre-Market Prep sessions or in my SteadyTrade Team daily webinars, then you know that’s been my refrain over and over this year.

But really, this crazy market run has been over a decade in the works. Think about it:

- 2009: An amazing bull market began…

- 2015: ‘Real money’ made its way into the penny stock market. I’m teasing you a little here — in an upcoming episode of the SteadyTrade podcast, the crew — Kim Ann Curtin, Stephen Johnson and I — interview a former market maker who reveals some mind-blowing truths about the penny stock market.

- 2016: A new president came to office — who talked about the stock market nonstop.

- 2019: Last fall, commission-free trading went viral — everyone started doing it.

- 2020: The pandemic brought on a shutdown and stimulus checks. Add that to the ‘Dave Portnoy effect’ — the idea that there wasn’t much sports betting going on — and you’ve got some serious bait to attract a ton of new traders.

Now, on the precipice of 2021, I’m changing the way I make watchlists to help you prepare yourself for the craziness that lies ahead.

New Year (Almost), New Weekly Watchlist Format

This new format’s gonna include a video and written roundup every week.

Why the new format? A few reasons…

For one, I don’t just wanna give you tickers — I want to go into a little more detail about the ‘how’ and ‘why’ about each stock on the watchlist.

I know that everyone learns and digests information differently — maybe you prefer the video, or maybe you like to see it all written. Now, you’ve got the choice.

These watchlists are in no way a recommendation to buy. Your trades are your decisions. But these are some tickers that have caught my eye on StocksToTrade scans … take a look and learn something from every pick.

I want you to always be looking to improve and trying to get a little better every day. Education is what it takes to stay in this game for the long haul!

Here’s what I’m watching this week:

Weekly Top Stocks List: December 14, 2020

AirBnB Inc. (NASDAQ: ABNB)

I know, I know … I don’t talk about IPOs too much. AirBnB’s IPO just debuted a couple of days ago — but this is a weekly watchlist, so I’m saying it’s worth watching.

ABNB opened way above expectations. Now it’s consolidating. But I think it’s got good prospects. Travel’s comeback is slow going, but people seem to be a lot more comfortable in AirBnbs than hotels right now. Hosts are reporting record bookings. If it starts hitting highs, buying could beget more buying…

Prepare yourself for the week ahead by watching these videos:

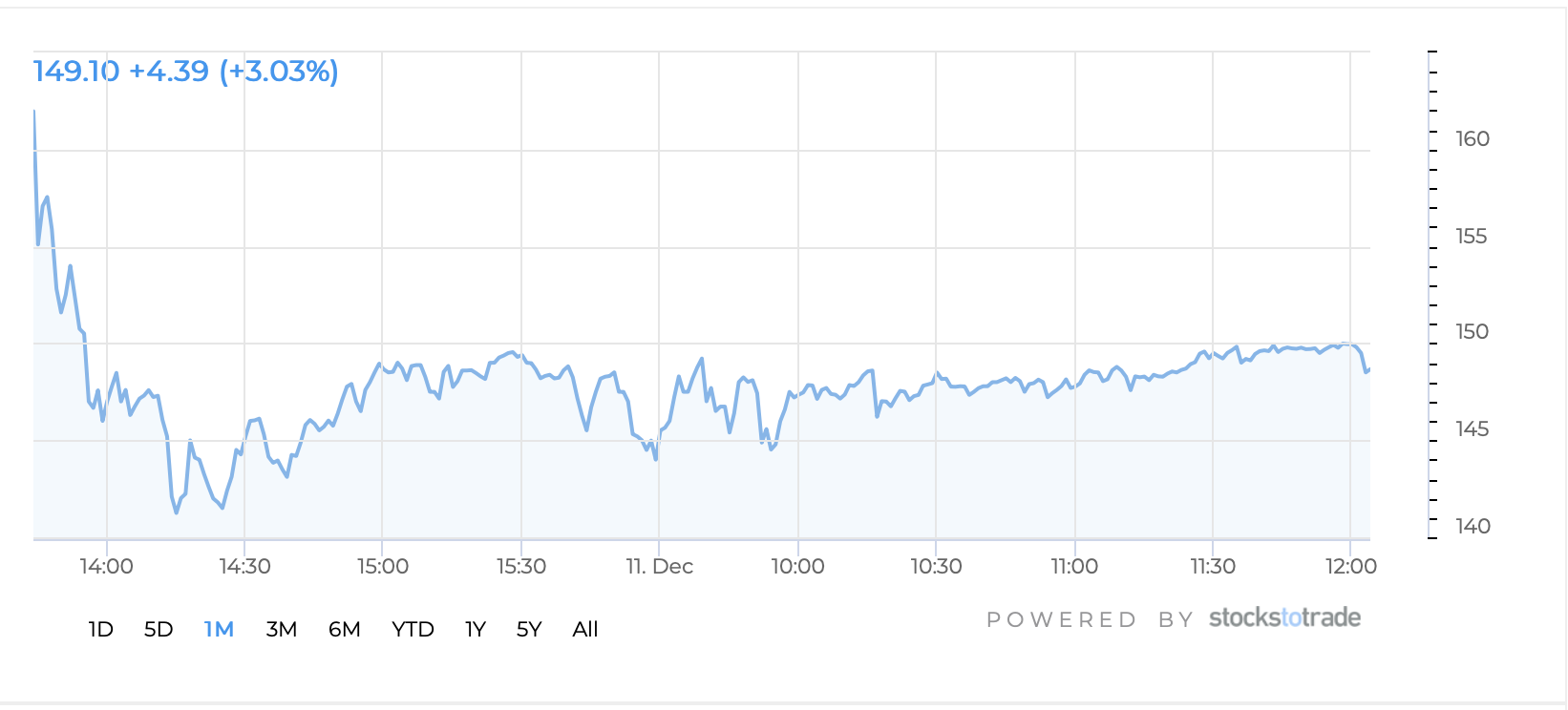

Check out the chart:

Boeing Co. (NYSE: BA)

Boeing got POUNDED back in March after the 737 Max debacle and travel shutdowns, going from the $340s to below $100 in a month.

But things could be turning around. The 737 is slowly going back into production. Travel is slowly coming back. Now it’s breaking out. It started coming back in June … Now I’m seeing a technical breakout at the $240 level. Could it reach pre-pandemic levels again?

Here’s the chart:

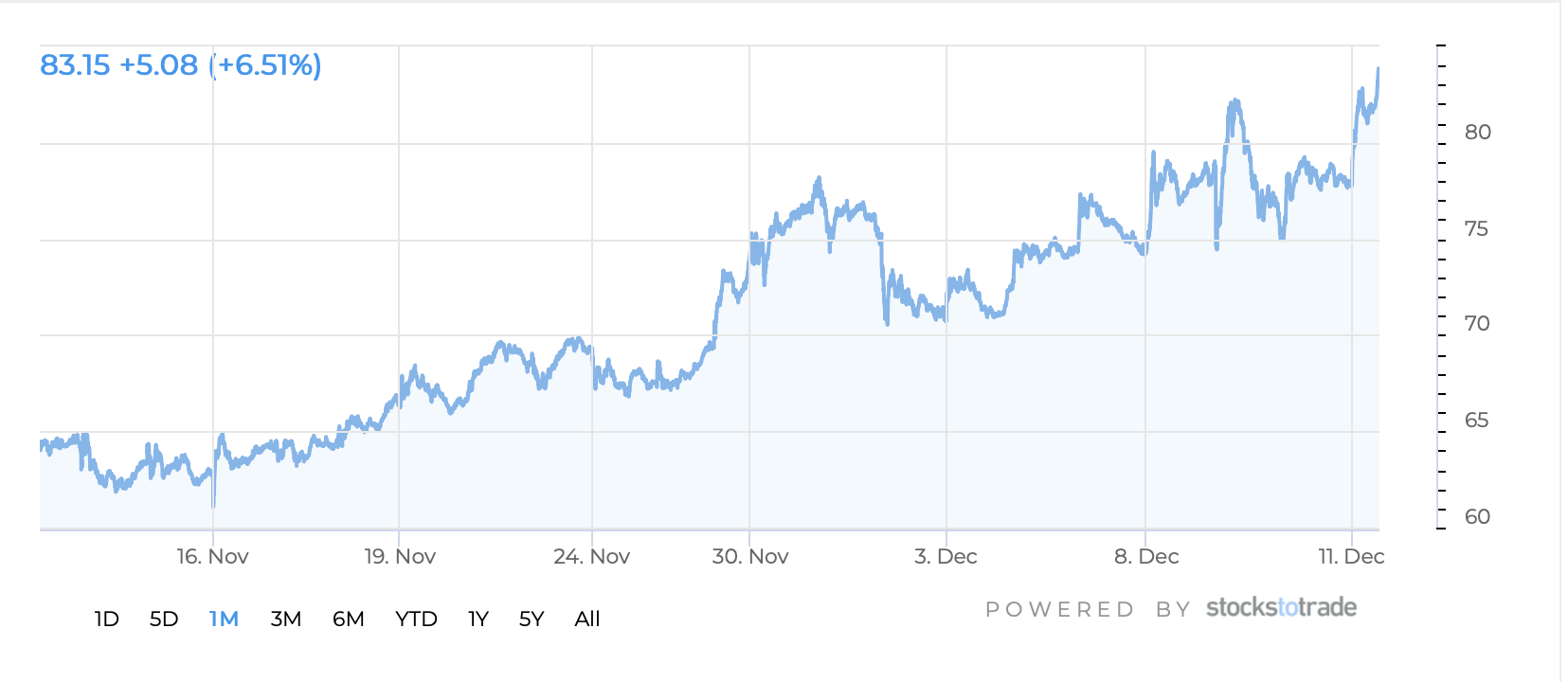

Chewy Inc. (NYSE: CHWY)

I’ve got a dog … and probably too many cats. In the early days of the pandemic, I happened to meet the FedEx guy at the door, and I noticed that his truck was about two-thirds full of Chewy boxes. I asked if that was normal, and he told me “it’s exploding … I used to have one, now I have 15.”

Chewy went on my watchlist on April 13, initially as a shelter-in-place idea … but really, it’s a technology play and e-commerce play too. It broke out at $40. In May and June it pulled back; since then it’s been on a nonstop grind.

Check it out:

Snap Inc (NYSE: SNAP)

Snapchat has been on my list off and on for a while now. Most recently, it had a big breakout on earnings in October — it went from $28 to $36 in one day. Now, it keeps grinding higher.

I think that a lot of people started turning away from Facebook and Twitter due to election fatigue. Platforms like Snapchat and Pinterest have a lot less political arguing. Plus, there could be more room to run if TikTok is blocked … I’m looking for weak open red to greens.

See what I mean about the grinding action?

Virgin Galactic Holdings Inc. (NYSE: SPCE)

I’m a total space exploration and technology nerd. I love following Space-X. But I also love following ‘smart money.’ Virgin Galactic was founded by Richard Branson — a smart guy and a serious success story.

SPCE is a beautiful breakout. From a chart perspective, when it breaks out, it tends to run. Big run, consolidate, big run. When it does run, it usually has multiple green days. If the market stays like it is, I wouldn’t be surprised to see new highs.

StocksToTrade

I love to read, and I’m a total nerd. But I’m not picking the tickers for this list out of thin air.

Smart trading requires the right tools. I scan for stocks using StocksToTrade. With awesome charting software and built-in scans, it’s got what traders need to narrow down the thousands of stocks out there into a manageable watchlist.

Plus, there are plenty of add-on features to give you an edge in trading, like the new Breaking News chat feature. Stock market pros narrow down news stories to the ones with the most promise for moving stocks … It’s a game-changer.

But don’t take my word for it. You can try StocksToTrade for 14 days for only $7.

Are You Watching?

As a trader, you’ve gotta keep educating yourself on what’s moving the market on a daily basis. Looking at watchlists like this can help you build that all-important base of knowledge. I hope you’ll use this watchlist as a learning tool.

Want to give us some feedback on the watchlist? Let us know what you think here.

But ultimately, the trades are on you. You’ve gotta figure out your own trading plans if you want to be a self-sufficient, consistent trader.

Check out my posts on creating a watchlist, and always keep your eye on the market. It’s changing fast these days!

And don’t forget … This watchlist is NOT a recommendation to buy. This is for educational purposes only — watch, learn, and use it to keep getting better every day!

What do you think of the new watchlist format? Fill out this quick survey to provide us some feedback!